EMEA compressor market 2020 - 2023

|

| Penetration of refrigerants by type, % of units, 2017 - 2023. |

Contents |

[edit] Introduction

In March 2021, BSRIA plans to publish a study on compressors used in three key applications: air conditioning (or comfort cooling), heat pumps for space and water heating and refrigeration. The study provides insight into changes in technologies and refrigerants. (This includes stationary applications only.)

[edit] Expanding markets

With the rapid growth taking place in the residential AC market in EMEA (Europe, the Middle East and Africa), sales of rotary compressors are expected to surge. In addition, more suppliers of domestic AC products have set up manufacturing in Europe and the Middle East to encourage proximity with their distributors. This will strengthen the market base for both rotary and scroll compressors used in AC units.

While recent years have seen demand for smaller capacity units in EU countries, sales of splits and other AC units in the commercial sector are expected to falter, as high-street retailers suffer from the double blow of COVID-19 and the growth of e-commerce, which is set to continue.

Above a certain threshold of 250-300 kW, screw compressors are largely used in chillers. Centrifugal oil-free compressors compete with screw but their use is more limited, due to their cost premium.

|

| HAC&R compressors by application, by volume (million units), 2020. |

[edit] Heat pumps

Despite the impact of COVID-19 and the lockdown imposed in EMEA countries, the heat pump market in 2020 held up remarkably well and registered growth. Heat pumps are surfing on a wave of legislation and other drivers for the decarbonisation of buildings, in particular of heating systems.

For those heat pumps that are entirely manufactured in EMEA, this encourages the market for rotary compressors in capacities up to 10 kW and scroll compressors in the range above. Screw compressors are also used in units sold for large industrial applications including district heating, starting at about 200 kW capacity and reaching above 2 MW.

|

| Sales vs production of HAC&R compressors by type, by volume (units), 2020 and 2023. |

The refrigeration sector is a key market for compressors in EMEA, as there are several very important suppliers of refrigeration units operating in the region. It accounts for a significant share of compressors, in particular for reciprocating types. In the long run, scroll compressors are not expected to take market share from semi-hermetic reciprocating, as they are not able to handle the same breadth of applications and refrigerant types.

[edit] Refrigeration

The refrigeration sector is going towards a general reduction of energy required for food conservation. Energy saving has been pushed by legislation in several countries, in particular the European Union, where directives such as Ecodesign and Ecolabel, which are under revision, have driven the uptake of electronic speed variation in compressor motors.

In EMEA, refrigerants are following the general trend of a shift towards alternatives with lower global warming potential, and the European Union is at the forefront of this move. While the AC industry is operating the move towards R32, which is a stopgap rather than a long-term solution, other refrigerants for large compressors operating at lower pressure include pure HFO such as R1234ze. CO2 or hydrocarbons such as propane (R290) remain limited to specific products and climates.

While the majority of the domestic HP market is still using R410A, there are more initiatives towards using propane in outdoor units for HP than in AC. In addition, the use of R1234ze in large screw units, with its large temperature range, allows for a growth in the market for commercial heat pumps.

Finally, while the domestic refrigeration market is dominated by isobutane (R600a), in commercial applications the use of R404A faltered when HFO/HFC blends became available. While CO2 has become widespread in compressor racks for supermarkets (and propane in plug-in refrigerated display cases), it is expected that HFO blends with low GWP will benefit from the phase out of R404A.

This article originally appeared on the BSRIA website with the headline, 'EMEA Compressor market set to recover in line with OEM markets despite COVID-19 setback'. It was published in February 2021.

--BSRIA

[edit] Related articles on Designing Buildings Wiki

Featured articles and news

Retrofit 25 – What's Stopping Us?

Exhibition Opens at The Building Centre.

Types of work to existing buildings

A simple circular economy wiki breakdown with further links.

A threat to the creativity that makes London special.

How can digital twins boost profitability within construction?

The smart construction dashboard, as-built data and site changes forming an accurate digital twin.

Unlocking surplus public defence land and more to speed up the delivery of housing.

The Planning and Infrastructure Bill

An outline of the bill with a mix of reactions on potential impacts from IHBC, CIEEM, CIC, ACE and EIC.

Farnborough College Unveils its Half-house for Sustainable Construction Training.

Spring Statement 2025 with reactions from industry

Confirming previously announced funding, and welfare changes amid adjusted growth forecast.

Scottish Government responds to Grenfell report

As fund for unsafe cladding assessments is launched.

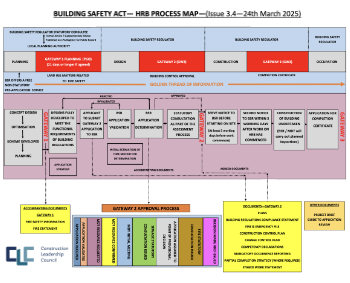

CLC and BSR process map for HRB approvals

One of the initial outputs of their weekly BSR meetings.

Architects Academy at an insulation manufacturing facility

Programme of technical engagement for aspiring designers.

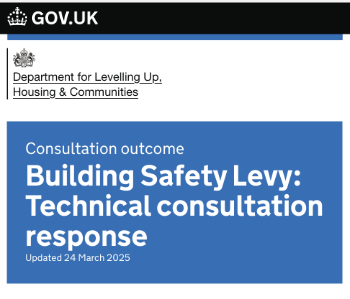

Building Safety Levy technical consultation response

Details of the planned levy now due in 2026.

Great British Energy install solar on school and NHS sites

200 schools and 200 NHS sites to get solar systems, as first project of the newly formed government initiative.

600 million for 60,000 more skilled construction workers

Announced by Treasury ahead of the Spring Statement.

The restoration of the novelist’s birthplace in Eastwood.

Life Critical Fire Safety External Wall System LCFS EWS

Breaking down what is meant by this now often used term.

PAC report on the Remediation of Dangerous Cladding

Recommendations on workforce, transparency, support, insurance, funding, fraud and mismanagement.

New towns, expanded settlements and housing delivery

Modular inquiry asks if new towns and expanded settlements are an effective means of delivering housing.